.jpg?1770577022)

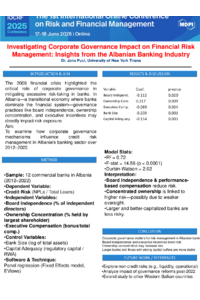

The 1st International Online Conference on Risk and Financial Management

Big Data, Artificial Intelligence, and Machine Learning in Finance

Part of the International Online Conference on Risk and Financial Management series

17–18 June 2025

Risk Management, Financial Management, Predictive Modeling, Financial Technology, Quantitative Risk Analysis, Algorithmic Trading, Financial Forecasting, Economic Modeling, Big Data Artificial Intelligence and Machine Learning

- Go to the Sessions

- Event Details

-

- Winner Announcement

- Welcome from the Chair

- Program Overview

- IOCRF 2025 Program (DAY 1)

- IOCRF 2025 Program (DAY 2)

- Live Session Recordings

- Abstract Book

- Poster Gallery

- Event Chairs

- Event Speakers

- Sessions

- List of Accepted Submissions

- Registration

- Instructions for Authors

- Publication Opportunity

- Event Awards

- Sponsors and Partners

- Conference Secretariat

- Events in series IOCRF

The IOCRF 2025 Conference Closed!

Best Oral Presentation Awards and Best Poster Award of IOCRF2025 have been evaluated.

Please refer to Winner Announcement.

Download your Certificate of Attendance HERE.

All participants are welcome to submit a paper to a Special Issue in JRFM, with a 20% discount on the APC.

Click HERE for more details.

For any inquiry, please contact us at iocrf2025@mdpi.com.

Winner Announcement

On behalf of the chairs of IOCRF 2025, we are pleased to announce the winners of the Best Oral Presentation Awards and Best Poster Award.

The Best Oral Presentation Awards have been awarded to

- sciforum-119257, "A Quantum Leap in Asset Pricing:Explaining Anomalous Returns", James Kolari, Jianhua Huang, Wei Liu, Huiling Liao.

- sciforum-120644, "AI-Driven Policy Effects on Stock Market Anomalies: Evidence from China's Digital Finance Era", Keyao WANG.

- sciforum-115626, "Identifying financial statement frauds via machine learning: A comparative analysis based on Chinese listed companies", Yue Chen, Guanming He.

- sciforum-114357, "Leveraging Federated Learning for Enhancing Anti-Fraud Systems in Fintech: Opportunities and Challenges", Leo S.F. Lin.

- sciforum-116980, "Connectedness between Islamic Cryptocurrencies and Green Assets: Deep Insights from Extreme Events", Rija Anwar, Syed Raza.

The Best Poster Award has been awarded to

- sciforum-119834, "Comparing the predictive abilities of artificial intelligence and traditional finance models", Tianrong Zhuang.

Welcome from the Chair

I want to offer a warm welcome to all conference participants of the 1st International Online Conference on Risk and Financial Management—Big Data, Artificial Intelligence, and Machine Learning in Finance (IOCRF2025), which will take place virtually over two days from 17 to 18 June 2025. The conference is sponsored by MDPI and the scientific journal JRFM (Journal of Risk and Financial Management), a peer-reviewed, open access journal that focuses on risk management and all areas of empirical finance, management and applied financial economics.

This conference will feature sessions on the following topics:

· Machine learning in economics and finance;

· AI in economics and finance;

· AI in financial reporting and auditing;

· Financial innovations and technology;

· Future of money: central bank digital currencies, cryptocurrencies and stablecoins.

This event will be held entirely online, allowing participants from all over the world to participate without concerns regarding travel and related expenditures. This conference format is particularly appropriate and useful because research concerned with AI and big data applications in empirical finance is progressing rapidly. An electronic conference provides a platform for rapid and direct exchanges about the latest research findings and novel ideas.

Participation, as well as attendance of this online conference, is free. Participants will have the opportunity to examine, explore and critically engage with issues and advances in these areas. We hope to facilitate discussions and exchange within the community.

Outstanding contributions from each session will be eligible for conference awards. Moreover, instead of limiting presentations to a live poster session, all IOCRF2025 participants have the opportunity to upload and display their research in the form of a poster at the poster gallery on the conference website. Therefore, all participants with poster submissions for the poster gallery are now eligible for awards! Please click HERE for more instructions on poster and oral submissions.

Lastly, we would like to express our sincere gratitude for your unwavering support and participation, and to wish this conference every success.

Kind Regards,

Prof. Dr. Thanasis Stengos

University of Guelph, Canada

Chair of the 1st International Electronic Conference on Risk and Financial Management—Big Data, Artificial Intelligence, and Machine Learning in Finance

Follow the conference organizer on Social Media

Program Overview

| Day 1 | Day 2 | |

| 17 June - Morning | 18 June - Morning | |

| Session 3. AI in Financial Reporting and Auditing | Session 5. Future of Money: Central Bank Digital Currencies, Cryptocurrencies and Stablecoins | |

| Break | ||

| 17 June - Afternoon | 18 June - Afternoon |

|

| Parallel Sessions | ||

| Session 2. AI in Economics and Finance | Session 4. Financial Innovations and Technology | Session 1. Machine Learning in Economics and Finance |

IOCRF 2025 Program (DAY 1)

Program for DAY 1

Day 1 Morning Activity

EDT (New York) + 18 hr from the timetable

|

CEST |

Speaker |

Title |

|

9:00-9:05 |

Prof. Dr. Issam Benhayoun |

Welcome from the Session Chair |

|

9:05-9:35 |

Dr. Rohaida Basiruddin |

Guardian or Threat? AI’s Dual Role in Financial Reporting Integrity and Earnings Management |

|

9:35-9.55 |

Dr. Khairul Ayuni Mohd Kharuddin |

Transforming the Accounting Profession with Artificial Intelligence: Benefits, challenges, and opportunities |

|

9:55-10:25 |

Prof. Dr. Issam Benhayoun |

From Black Box to Glass Box: The Role of Explainable Artificial Intelligence (XAI) in Financial Reporting and Accounting |

|

10:25-10:40 |

Guanming He |

Identifying financial statement frauds via machine learning: A comparative analysis based on Chinese listed companies |

|

10:40-10:55 |

Yanying Li |

The Readability Level in Annual Reports of Chinese Listed Companies and the Manipulative Behaviors of Managers for Self-Serving Incentives |

|

10.55-11.10 |

Michael Masunda |

Disruption in Southern Africa's Money Laundering Activity by AI-Tech |

|

11.10-11.25 |

Dr. Ahmad Khan |

AI's Role in Shaping the Future of Economic and Financial Analysis in the Pursuit of the Macroeconomic Scenario |

|

11.25-11.55 |

Prof. Dr. Javad Izadi |

To be announced |

Program for DAY 1

Date: 17 June 2025 (Tuesday)Day 1 Afternoon Activity (Parallel Session)

Session 2 and Flash Poster Part

Time: 14:30 (CEST, Basel) | 8:30 (EDT, New York) | 20:30 (CST Asia, Beijing)

EDT (New York) + 18 hr from the timetable|

CEST |

Speaker |

Title |

|

14:30-14:35 |

Prof. Dr. Svetlozar (Zari) Rachev |

Welcome from the Session Chair |

|

14:35-14:55 |

Prof. Dr. Shumi Akhtar |

Business and Entrepreneurship Will Never Be the Same — AI & Digital Transformation |

|

14:55-15:15 |

Prof. Dr. Piotr Fiszeder |

Identification of Bitcoin Volatility Drivers Using Statistical and Machine Learning Methods |

|

15:15-15:45 |

Dr. Young Shin Kim |

Risk-Neutral Pricing of Quanto Options with Generative Machine Learning Techniques |

|

15:45-16:00 |

Kamran Razzaq |

Future of Corporate Finance: Advancing Decision-Making with Machine Learning and AI Technologies |

|

16:00-16:15 |

Keyao Wang |

AI-Driven Policy Effects on Stock Market Anomalies: Evidence from China's Digital Finance Era |

|

16:15-16:30 |

Serkan Karadas |

Using ChatGPT in Asset Allocation Recommendations |

|

16:30-16:45 |

Mounira Raddaoui |

Innovative debt financing to bridge Saudi Arabia's climate and economic gaps |

|

16:45-17:00 |

Rawnaa Sayed Saed Ibrahim |

A Comprehensive Framework for Credit Card Fraud Detection |

|

17:00-17:25 |

Flash Poster Presentation |

Shuchi Zhang |

Session 4 and Flash Poster Part

EDT (New York) + 18 hr from the timetable

|

CEST |

Speaker |

Title |

|

|

15.00-15.05 |

Prof. Dr. Xianrong (Shawn) Zheng |

Welcome from the Session Chair |

|

|

15.05-15.25 |

Prof. Dr. Xianrong (Shawn) Zheng |

Investing in the Age of Generative AI: A GPT-based Sentiment Analysis Approach |

|

|

15.25-15.45 |

Dr. Ann-Ngoc Nguyen |

Decentralized Finance (DeFi) - The New Financial Paradigm |

|

|

15.45-16.05 |

Dr. Dimitrios Koutmos |

Cryptocurrencies & Blockchain Research: Past, Present, Future |

|

|

16.05-16.35 |

Dr. Leo H. Chan |

Alpha Darkhorse or Trojan Horse? A comprehensive Analysis of Leveraged ETFs |

|

|

16.35-16.50 |

Leo S.F. Lin |

Leveraging Federated Learning for Enhancing Anti-Fraud Systems in Fintech: Opportunities and Challenges |

|

|

16.50-17.05 |

Bianca Benedict |

Trading Emotions in Day Trading: Experimental Evidence on The Synergy between Humans and Trading Robots |

|

|

17.05-17.20 |

Stavros Pantos |

“Learning from your neighbours”: prudential provisions of the EU AI Act for the UK insurance supervisory regime |

|

|

17.20-17.35 |

Abolhasan Jalilvand |

Does ESG Affect Bank Risk? |

|

|

17.35-17.50 |

Teodora Mitu |

The Behavior of European Financial Markets under the Risk Pressure. Calculating the Value at Risk of a Stock Portfolio Using Python |

|

|

17.50-18.10 |

Flash Poster Presentation

|

Alexandru Vasile Rusu Financial Innovations and AI-Driven Management in Romania’s Tourism and Public Catering Sector Muhammad Arslan Blockchain and Artificial Intelligence in Sustainable Finance: A Thematic Analysis Fabrizio Di Sciorio Integrating the implied regularity into implied volatility models: A study on free arbitrage model Angelo Kalafatas Statistical Dangerousness: a novel tool that foresees the dangers |

|

IOCRF 2025 Program (DAY 2)

Program for DAY 2

Day 2 Morning Activity

|

CEST |

Speaker |

Title |

|

|

9:00-9:05 |

Prof. Dr. Ramona Rupeika-Apoga |

Welcome by the Session Chair |

|

|

9:05-9:35 |

Dr. Nikolaos Daskalakis |

Crypto and Blockchain in the Era of MiCA and DLTR |

|

|

9:35-10:05 |

Prof. Dr. Ramona Rupeika-Apoga |

Bitcoin's Monetary Metamorphosis: From Concept to Currency? |

|

|

10:05-10:25 |

Dr. Ahmed Eltweri |

Central Bank Digital Currencies and the Challenges of Financial Crime in a Digital Bartering Economy |

|

|

10:25-10:45 |

Dr. Kirill Shakhnov |

The Evolving Structure of Crypto Markets: Fragmentation, Risk, and Regulation |

|

|

10:45-11:00 |

Papa Ousseynou Diop |

Binance USD Delisting and Stablecoin Repercussions: A Local Projections Approach |

|

|

11:00-11:15 |

Georgios Papapanagiotou |

On the time-varying causal relationships that drive bitcoin returns |

|

|

11:15-11:30 |

Rija Anwar |

Connectedness between Islamic Cryptocurrencies and Green Assets: Deep Insights from Extreme Events |

|

|

11:30-11:45 |

Srijanie Banerjee |

Understanding Attitude Towards Central Bank Digital Currency for Inducing Financial Inclusion: A Constructivist Analysis of Attitude Formation and Adoption Framework |

|

|

11:45-11:55 |

Flash Poster Presentation |

Mohamed Rochdi Keffala Leo S.F. Lin |

|

Program for DAY 2

Date: 18 June 2025 (Wednesday)Time: 14:30 (CEST, Basel) | 8:30 (EDT, New York) | 20:30 (CST Asia, Beijing)

Day 2 Afternoon ActivityEDT (New York) + 18 hr from the timetable

|

CEST |

Speaker |

Title |

|

14:30-14:35 |

Prof. Dr. Thanasis Stengos |

Welcome by the Session Chair |

|

14:35-15:05 |

Dr. Mohamed Chaouch |

Functional conditional volatility modeling with missing data |

|

15:05-15:35 |

Prof. Dr. Alexandra Horobet |

The ESG-Finance Nexus: A Sectoral Perspective Using Random Forests |

|

15:35-15:50 |

Fennee Chong |

Predicting Residential Housing Prices using Machine Learning Approach |

|

15:50-16:05 |

Manuel Salas-Velasco |

Evaluating the Effectiveness of Chatbots in Financial Education for Postgraduate Decision-Making |

|

16:05-16:20 |

Fabrizio Di Sciorio |

Identifying Market Dynamics Through the Hurst Exponent |

|

16:20-16:35 |

Julien Chevallier |

Navigating international stock markets using nonlinear quantitative investing methods |

|

16:35-16:50 |

Akash Deep |

Risk-Adjusted Performance of Random Forest Models in High-Frequency Trading |

|

16:50-17:05 |

Annalisa Ferrari |

Decoding ESG's Impact on Conditional Beta: Insights from Eurostoxx 600 |

|

17:05-17:20 |

James W. Kolari |

A Quantum Leap in Asset Pricing:Explaining Anomalous Returns |

|

17:20-17:40 |

Flash Poster Presentation |

Mogari Ishmael Rapoo Rakshith Bhandary Javid Huseynov Tianrong Zhuang Peujio Fozap Francis Magloire |

|

17:40-17:45 |

Closing speech by |

|

Live Session Recordings

Abstract Book

Event Chair

Department of Economics and Finance, University of Guelph, Canada

Thanasis Stengos joined the Department of Economics at the University of Guelph in 1984, where he held a University Research Chair from 2004 to 2019. He received his B.Sc. and M.Sc. in Economics from the London School of Economics and Ph.D. from Queen's University. He currently serves as Associate Editor of the Journal of Applied Econometrics and Empirical Economics and he is the editor-in-chief of the Journal of Risk and Financial Management and co-editor of the Review of Economic Analysis. His research has been published in many journals including the Review of Economic Studies, European Economic Review, International Economic Review, The Economic Journal, The Econometrics Journal, Journal of Monetary Economics, Journal of Econometrics, Econometric Theory, The Review of Economic and Statistics, Journal of Applied Econometrics, Journal of Business and Economic Statistics and Journal of Economic Growth.

Session Chairs

Prof. Dr. Thanasis Stengos

Department of Economics and Finance, University of Guelph, Canada

nonparametric econometrics; applied time series models; empirical finance; empirical growth

Thanasis Stengos joined the Department of Economics at the University of Guelph in 1984, where he held a University Research Chair from 2004 to 2019. He received his B.Sc. and M.Sc. in Economics from the London School of Economics and Ph.D. from Queen's University. He currently serves as Associate Editor of the Journal of Applied Econometrics and Empirical Economics and he is the editor-in-chief of the Journal of Risk and Financial Management and co-editor of the Review of Economic Analysis. His research has been published in many journals including the Review of Economic Studies, European Economic Review, International Economic Review, The Economic Journal, The Econometrics Journal, Journal of Monetary Economics, Journal of Econometrics, Econometric Theory, The Review of Economic and Statistics, Journal of Applied Econometrics, Journal of Business and Economic Statistics and Journal of Economic Growth.

Prof. Dr. Svetlozar (Zari) Todorov Rachev

Department of Mathematics and Statistics, Texas Tech University, Lubbock, USA

mathematical and empirical finance; probability metrics; mass transportation problems

Prof. Svetlozar (Zari) Todorov Rachev is a professor at Texas Tech University, specializing in mathematical finance, probability theory, and statistics. He is internationally recognized for his work in probability metrics, derivative pricing, and financial risk modeling. Prof. Rachev co-founded FinAnalytica and developed its flagship risk management engine. He has authored over 400 academic publications in mathematics and finance. His Google Scholar h-index is 70, including 33 since 2020. He has held appointments at UCSB, Stony Brook, KIT, and the Steklov Institute.

Dr. Mahmoud Elmarzouky

St Andrews Business School, University of St Andrews, St Andrews, UK

corporate narrative disclosure; content analysis; textual analysis; sustainable development goals (SDGs); climate change; carbon emission; financial reporting standards; corporate governance

Dr. Mahmoud Elmarzouky holds a PhD in Accounting and is a Fellow of the Higher Education Academy, with over 18 years of experience spanning academic and professional careers. He is currently the Director of Research at St Andrews Business School and the Study Abroad Coordinator for the management department. His research interests cover areas such as SDGs, textual analysis, narrative disclosure, sustainability, carbon emissions, modern slavery, corporate governance, and financial reporting quality. Dr. Elmarzouky has published 33 peer-reviewed international publications in leading journals such as Journal of Environmental Management, Business Strategy and the Environment, Journal of Business Research, Technological Forecasting and Social Change, Journal of International Accounting, Auditing and Taxation, and International Journal of Economics and Finance, among others. He is currently an Associate Editor at Business Strategy and the Environment, actively contributing to the advancement of research in sustainability, governance, and corporate disclosure. Dr. Elmarzouky has been awarded several prestigious grants, including funding from The International Association for Accounting Education and Research (IAAER) and KPMG in 2023 to develop international accounting reporting standards. He also secured two grants from The British Academy, in 2022 and 2024, for projects on modern slavery practices in the UK and corporate crime deterrence, respectively. Additionally, he was a research associate for a project funded by the Financial Reporting Council (FRC), investigating remuneration reporting changes following the UK Corporate Governance Code 2018. He has also received multiple grants from Kingston Business School for developing measures of corporate modern slavery disclosure and examining these disclosures from a gender socialization perspective. Furthermore, he was awarded a bursary from the Asia-Pacific Management Accounting Association (APMAA).

Prof. Dr. Xianrong (Shawn) Zheng

Information Technology & Decision Sciences Department, Old Dominion University, USA

AI; cloud computing; FinTech

Dr. Xianrong (Shawn) Zheng is an Associate Professor of Information Technology, Old Dominion University, Norfolk, Virginia, United States. He received his Ph.D. degree in Computer Science from Queen's University, Kingston, Ontario, Canada, in 2014. His research interests are AI, Cloud Computing, Data Science, and FinTech. Dr. Zheng is a Member of Association for Computing Machinery (ACM). He is the Editor-in-Chief of International Journal of Web Portals (IJWP), an Editorial Board Member of International Journal of Data Science (IJDS), and a Technical Program Committee Member of IEEE International Conference on Web Services (IEEE ICWS). Also, he is the Guest Editor of Special Issues “Financial Data Science in the Era of Generative AI” for European Financial Management (EFM), “Financial Technologies (FinTech) in Finance and Economics” for Journal of Risk and Financial Management (JRFM), etc.

Prof. Dr. Ramona Rupeika-Apoga

Faculty of Business, Management and Economics, University of Latvia, Latvia

FinTech; alternative financing; international finance; banking

Ramona Rupeika-Apoga is a Professor of Finance and Head of the Department of Finance and Accounting at the University of Latvia. She also serves as a Visiting Professor at the University of Lodz (Poland) and an Affiliate Professor at the University of Malta. With over 20 years of experience in higher education, she specializes in risk management, international finance, FinTech, and corporate digital transformation. Professor Rupeika-Apoga has led and contributed to numerous international and national research projects, making her a recognized expert in her field across European academic and professional communities.

Event Committee

Department of Finance, Control and Law, Montpellier Business School, Montpellier, France

cryptocurrencies/bitcoins; big data analytics; corporate finance; energy finance; green supply chain/circular economy

Department of Economics, Seoul National University, Seoul, Republic of Korea

econometric theory; applied econometrics; financial econometrics

Faculty of Finance, Cass Business School, City, University of London, London, UK

commodity markets; financial forecasting; asset pricing; financial crises; credit risk

Laboratoire d'Économie Dionysien (LED), University Paris 8, Saint-Denis, France

empirical finance; computational econometrics; commodities

Leonard N. Stern School of Business, New York University, New York, USA

finance; monetary economics; econometrics; international economics

Department of Agricultural Economics & Agribusiness, Louisiana State University-LSU AgCenter, Baton Rouge, Louisiana, USA

econometrics; financial econometrics; risk management; financial analysis; international trade & development; agricultural marketing; prices

Department of Economics, University of Zurich, Zürich, Switzerland

Health Economics; insurance economics; regulation; innovation in insurance; the production of health

Graduate School of Business and Law (GSBL), RMIT University Australia, Melbourne, Australia

quantitative finance; corporate finance; asset pricing; applied mathematics

Finance and Sustainable Development, Université Nice Sophia Antipolis, Nice, France

emerging markets; asset pricing; portfolio management; behavioral finance; interaction between commodities, asset prices and macroeconomic variables; corporate social responsibility (CSR)

Department of Finance, Faculty of Finance and Banking, Bucharest University of Economic Studies, Bucharest, Romania

corporate finance; corporate governance; quantitative finance; sustainable development

Department of Finance and Real Estate, Kogod School of Business, American University, Washington, D.C., USA

Behavioral finance corporate finance; dividend policy, survey research methodology

Faculty of Economics and Administration, University of Pardubice, Pardubice, Czech Republic

fuzzy systems, neuro-fuzzy systems and evolutionary fuzzy systems; financial risk prediction using computational intelligence methods; deep learning neural networks for spam prediction; decision support systems under uncertainty

market microstructure; banking and insurance; financial architecture; competing market (systems)

Faculty of Economics and Business, Business Administration Department, University of Oviedo, Oviedo, Spain

corporate investment; mutual funds; IPOs; CSR; sustainable finance

empirical finance; forecasting

Johns Hopkins School of Advanced International Studies (SAIS), Washington, USA

economics; international economics; international monetary economics; international trade theory and policy

Discipline–Accounting & Finance, Economics and Law, Federation University, Berwick, Australia

green infrastructure; finance

Director of Global Business Program, Faculty of International Liberal Arts, Akita International University, Akita, Japan

empirical finance; financial markets; macroeconomics; applied econometrics and investment

Department of Mechanical Engineering and Materials Science, Washington University in St. Louis, St. Louis, USA

CFD; reactive flows; combustion; chemical looping; carbon capture and sequestration

financial economic; macroeconomic; international finance and financial markets; behavioral finance and financial markets; ethical finance and sustainability; forecasting; advanced time series; high frequency data; advanced econometrics

1. Risk Methodology, Université Paris 1 Panthéon-Sorbonne, Paris, France,

2. Department of Computer Science, University College London, Bloomsbury, London, UK

Swarm Intelligence; AI and Ethics; Financial Risk Modelling; Deep Reinforcment Learning applied to Finance; Applied Quantum Mechanics; Aversarial Machine Learning

Department of Finance, Syracuse University, Syracuse, USA

risk management; operational risk; default risk; value-at-risk; corporate finance; applications of probability and statistics in finance; stochastic processes

School of Finance, Jiangxi University of Finance and Economics, Nanchang, China

blockchain; cryptocurrencies; FinTech; banking; financial markets

Department of Banking, School of Banking and Insurance, Ankara Haci Bayram Veli University, Besevler, Ankara, Turkey

banking and finance; risk management and analysis; applied economics and finance

College of Business, Al Ain University, Al Ain, United Arab Emirates

finance; Islamic finance; investment; tourism; environmental issues; corporate governance; financial performance; capital structure; SDGS; merges and acqusistions

corporate finance; corporate governance; executive compensation; mergers and acquisitions; banking

macroeconomics; energy economics; economic policy uncertainty; foreign exchange markets; corporate finance; asset pricing; applied econometrics

Marriott School of Business, Brigham Young University, Provo, USA

asset-pricing theory; empirical tests of asset-pricing models; econometrics

game theory in accounting and finance; accounting manipulations; entrepreneurial finance; entrepreneurship; crowdfunding; sports analytics; machine learning and big data

Faculty of Business Administration, Lakehead University, Thunder Bay, Canada

capital market implication of earnings quality; corporate governance and audit quality; accounting education

corporate finance; behavioural finance; sustainable finance; dividend policy; climate change anking; public finance; fintech

Department of Mathematical Sciences, School of Sciences, Tezpur University, Assam, India

functional analysis; fixed point theory and fractional calculus; fuzzy mathematics; Geographic Information System; mathematical statistics

1. Italian National Research Council (CNR), Rome, Italy,

2. Institute for Studies on the Mediterranean (ISMed), Napoli, Italy

economic history; credit and banking history; insurance history

1. Faculty of Economics, Management and Accountancy, Insurance and Risk Management Department, University of Malta, Msida, Malta,

2. Faculty of Business, Management and Economics, University of Latvia, Riga, Latvia

financial technologies; financial management and asset management; risk management; compliance and regulations; corporate finance; corporate governance; audit management; financial services; behavioral economics

School of Economics, Finance and Marketing, RMIT University, Melbourne, Australia

empirical asset pricing; stock market liquidity; behavioural finance; investments

Department of Economics, Management and Business Law, University of Bari "Aldo Moro", Bari, Italy

interbank markets; behavioural finance; systemic risk; agent-based models; network

corporate finance; financial intermediation; financial regulations

College of Management (AACSB), Yuan Ze University, Taoyuan City, Taiwan

basel accord; credit risk; deposit insurance

Department of Marketing, Faculty of Economics and Business Administration, Babes-Bolyai University Cluj-Napoca, Cluj-Napoca, Romania

retailing; marketing; retail marketing; international marketing; tourism marketing; consumer research; consumer generations; sustainable retailing; sustainable marketing; sustainable tourism

Institute of Economic Sciences, Hungarian University of Agricultural and Life Sciences, Budapest, Hungary

microeconomics; sustainable management

Faculty of Economics and Informatics and the Faculty of Business and Management Sciences, University of Novo Mesto, Novo Mesto, Slovenia

Tourism; econometrics; demand; hospitality industry; Time series

Accounting & Finance, Faculty of Arts and Society, Charles Darwin University, Darwin, Australia

emerging markets; portfolio construction; asset allocation; market integration; volatility transmission

Department of Decision Sciences and Economics, College of Business, Texas A&M University-Corpus Christi, Corpus Christi, Texas, USA

technology adoption; e-Commerce; mobile banking and payment; decision support systems; distance education; accounting information system

digital economy; higher education; sustainability; international business

Department of Economics, Faculty of Social, Political and Economics Sciences, Democritus University of Thrace, Komotini, Greece

finance; investments; insurance; pensions; portfolio management; applications

1. Department of International Business and Economics, Bucharest University of Economic Studies, Bucharest, Romania,

2. Institute for Economic Forecasting, Romanian Academy, Bucharest, Romania

asset bubbles; financial markets; asset pricing; monetary policy; credit risk; volatility modeling; financial econometrics; economic forecasting; risk management

Schroeder School of Business, University of Evansville, Evansville, Indiana, USA

accounting information systems; electronic financial reporting; foresnic accounting; accounting education; financial inclusion; non-financial reporting

Department of Financial and Business Systems, Lincoln University, 21 Ellesmere Junction Road, Lincoln, Christchurch, New Zealand

financial econometrics; financial markets; financial technologies; sustainability

Digital Finance Unit, Faculty of Management, University of Warsaw, Warsaw, Poland

payment systems; digital finance; two-sided markets; network and monetary economics

Foundations of Economic Analysis, Department of Economy, Universitat Jaume I, Castelló, Spain

behavioral economics and finance; computational economics; agent-based approches to economics; distributional methods in economics; financial econometrics

1. Institute of Data Science and Behavior Science, Civil Aviation Flight University of China, Guanghan, China,

2. Department of Finance, Oklahoma State University, Stillwater, Oklahoma, USA

dynamic asset pricing; fixed income and its derivatives; corporate finance; credit risk and risk management

Department of Economics, Hanyang University, Gyeongi-Do, Republic of Korea

international trade; investment; growth and development; applied theory; technology and innovation; human capital

Engineering and Management Department, Faculty of Design Industrial and Business Management, Gheorghe Asachi Technical University of Iasi, Iasi, Romania

public and private finance; financial management; performance management; micro and macroeconomics; entrepreneurship

Federation Business School, Federation University, Mount Helen, Australia

Scholarship of Accounting Education; Corporate Social Reporting, Interdisciplinary Accounting Research, Accounting History, and Accounting for Sport

Corporate disclosure; gender and equality, consumer behaviour; marketing; sustainable development goals (SDGs); corporate governance.

CiTUR—Centre for Tourism Research, Development and Innovation, Polytechnic University of Leiria, Leiria, Portugal

financial accounting; hospitality management accounting; financial sustainability; revenue management

Department of Finance, Mays Business School, Texas A&M University, College Station, TX, USA

asset pricing; banking; event study methods, interest rates, inflation rates, exchange rates

Keynote Speakers

Department of Mathematics, Statistics and Physics, Qatar University, Qatar

Speech Title: Functional conditional volatility modeling with missing data

Mohamed Chaouch is an Associate Professor of Statistics at Qatar University. He earned his Ph.D. in Statistics from the University of Dijon, France. His research focuses on statistical learning for massive and streaming data, functional time series analysis, copula-based modeling, and financial econometrics. He has published in leading journals such as Journal of Multivariate Analysis, Annals of the Institute of Statistical Mathematics, and Annals of Operations Research. He has presented invited talks at major conferences, including the International Symposium on Nonparametric Statistics and the ERCIM Conference on Computational and Methodological Statistics, and serves on editorial and scientific committees. With Prof. Thanasis Stengos, he’s currently Guest Editor of the Special Issue "Machine Learning Based Risk Management in Finance and Insurance", in JRFM.

Financial econometrics; statistical learning for big data; copula-based modeling; functional data

Department of International Business and Economics, Faculty of International Business and Economics, Bucharest University of Economic Studies, Bucharest, Romania

Title: The ESG-Finance Nexus: A Sectoral Perspective Using Random Forests Abstract: The nexus between Environmental, Social, and Governance (ESG) performance and financial outcomes has attracted considerable scholarly interest in recent years, though the complexities and latent synergies inherent in this relationship remain largely unexplored. This investigation utilizes Random Forest models to scrutinize the predictive capacity of ESG metrics on financial performance within European Union countries, accentuating sector-specific variations among corporations. Initially, the research seeks to ascertain whether ESG performance can reliably forecast financial metrics, including return on equity (ROE), return on assets (ROA), and stock returns, while identifying the relevant ESG dimensions influencing financial results. Subsequently, the study elucidates sectoral dynamics, demonstrating the variance in relevance of ESG factors across different industries with various ESG risk exposures. By binding the predictive and classificatory capacities of Random Forest modelling, the research offers actionable insights into the nuanced roles of ESG practices, thereby providing strategic guidance for corporate leaders, investors, and policymakers endeavouring to harmonize sustainability objectives with financial performance.

Alexandra Horobet is a professor at the Bucharest University of Economic Studies in Romania and a visiting professor at Excelia Business School in France. She holds a PhD in International Finance and an MA in European Transactions. Her research interests include corporate performance analysis and international finance and investments. More recently, she began working on financial and non-financial corporations’ engagement in sustainable practices and its impact on performance. Her works are published in top-tier journals, and she is Associate editor of the Journal of Risk Finance and the Review of Accounting and Finance.

currency risk management; corporate finance; international investments; risk analysis for corporate investment projects; international financial markets; risk analysis for international portfolios; international financial management; dynamic analysis of c

Speech Title: Risk-Neutral Pricing of Quanto Options with Generative Machine Learning Techniques

Dr. Young Shin Aaron Kim earned his Ph.D. from Sogang University in Korea in 2005 and completed his Habilitation at Karlsruhe Institute of Technology in Germany in 2011. His research focuses on mathematical modeling in finance, particularly in areas such as fat-tails, asymmetric dependence, volatility clustering, and long-range dependence. He has contributed extensively to financial risk management, portfolio management, and derivative pricing. Dr. Kim has published over 50 peer-reviewed papers and holds one patent. An expert programmer, he shares his custom-developed libraries and tools. Aaron is also studying AI in finance to enhance quantitative and data-driven financial analysis.

Financial Risk Management, Derivative pricing and hedging, Machine Learning & Artificial Intelligence, Mathematical and statistical modeling with Levy Process, time varying volatility, asymmetric dependence, fattails and long range dependence.

The Claude Littner Business School, University of West London, London, UK

financial reporting; financial market; cryptocurrency

Azman Hashim International Business School, Universiti Teknologi Malaysia, Kuala Lumpur, Malaysia

Speech Title: Guardian or Threat? AI’s Dual Role in Financial Reporting Integrity and Earnings Management

Dr. Rohaida Basiruddin is an Associate Professor at Azman Hashim International Business School, Universiti Teknologi Malaysia (UTM). She holds a PhD in Accounting and Finance from Durham University, UK. Her research focuses on earnings management, financial reporting quality, audit practices, and corporate governance. She has published widely in international journals and has led several research and consultancy projects in the field of financial integrity and business ethics. Dr. Rohaida is actively involved in academic leadership, curriculum development, and professional training. Her work is dedicated to enhancing transparency, accountability, and ethical standards in financial reporting and assurance.

corporate governance, audit quality, earnings management and shariah governance

National School of Business and Management - Meknes (ENCG-Meknes), Moulay Ismail University, Meknes, Morocco

Speech Title: From Black Box to Glass Box: The Role of Explainable Artificial Intelligence (XAI) in Financial Reporting and Accounting

Dr. Issam Benhayoun is Associate Professor of Accounting and Finance at ENCG-Meknes, Moulay Ismail University, Morocco, and part-time faculty at Al Akhawayn University. His research focuses on IFRS, IFRS for SMEs, ISSB standards, and the integration of AI and ML in auditing and sustainability reporting. A former Senior Executive and Head of Management Control, he brings practical expertise to his academic work. He also consults on IFRS adoption and financial management. Dr. Benhayoun’s work bridges academia and industry, contributing to both theoretical development and real-world application in accounting and finance.

Department of Finance and Economics, Woodbury School of Business, Utah Valley University, Orem, USA

Speech Title: Alpha Darkhorse or Trojan Horse? A comprehensive Analysis of Leveraged ETFs

Dr. Leo H. Chan is an associate professor of finance at the Woodbury School of Business at Utah Valley University. He has been teaching value-style investing for over 20 years. He has published over 30 articles in referred journals related to options, futures, international financial markets, and valuation. His article "Using Essays of Warren Buffett in the Classroom" is one of the most widely read paper on Warren Buffett's investment philosophy. He is also a regular contributor to financial education sites such as Nerd Wallet, Wallet Hub, and Credit Monkey.

investments; financial markets and institutions; options and futures; machine learning; artificial intelligence

Faculty of Business, Management and Economics, University of Latvia, Latvia

Speech Title: Bitcoin's Monetary Metamorphosis: From Concept to Currency? Abstract: The critical examination of Bitcoin's status as money and its effectiveness in performing traditional monetary functions is essential. We will explore the psychological foundations of value, examining how collective belief and acceptance confer value to Bitcoin. The discussion will address Bitcoin's roles as a medium of exchange, store of value, and unit of account, and critically assess its effectiveness in these roles compared to traditional currencies. Additionally, we will consider the regulatory landscape, market dynamics, and challenges such as volatility and environmental impact. This analysis aims to provide a nuanced understanding of Bitcoin's potential and limitations in redefining the concept of money in the digital age.

FinTech; alternative financing; international finance; banking

Finance and Accounting,Department of Public Administration,Panteion University , Athens, Greece

Speech Title: Crypto and Blockchain in the Era of MiCA and DLTR

Dr. Nikos Daskalakis is Associate Professor of Finance and Accounting at the Department of Public Administration, Panteion University, Athens. A seasoned researcher, he has published widely in top academic journals, amassing over 2,000 citations. His current interests include crowdfunding, blockchain in finance, and SME access to capital. He co-authored An Introduction to Cryptocurrencies (Routledge, 2020) and FinTech and Cryptoeconomy (Propompos, 2023). Dr. Daskalakis has advised major European financial bodies and currently serves on the SMSG-ESMA. He has also contributed to the IRSG-EIOPA, BSG-EBA, FSUG-EC, and ECSF-EC.

financial innovation - crowdfunding and blockchain applications in finance; SMEs access to finance; behavioural finance; capital structure

Invited Speakers

Faculty of Economic Sciences and Management, Nicolaus Copernicus University in Torun, Torun, Poland

Speech Title: Identification of Bitcoin Volatility Drivers Using Statistical and Machine Learning Methods

Fiszeder Piotr is a Full professor at Nicolaus Copernicus University in Toruń, Poland. Author of over 80 academic publications in financial econometrics and empirical finance, published in prestigious journals such as Applied Soft Computing, International Journal of Forecasting, Journal of Economic Dynamics and Control, Journal of Empirical Finance, Energy Economics, Energies, and Economic Modelling. He has participated in numerous research projects funded by the Ministry of Science and Higher Education in Poland, the European Community's Phare ACE Programme, and the Czech Science Foundation. Currently, he leads a research project entitled “Robust Methods for Range-Based Models: Risk and Comovement Analysis on the Cryptocurrency Market,” financed by the National Science Centre.

financial econometrics; empirical finance; volatility models; cryptocurrencies; energy markets

Finance Discipline, Business School, University of Sydney, Sydney, Australia

Speech Title: Business and Entrepreneurship Will Never Be the Same — AI & Digital Transformation

Associate Professor Dr. Akhtar is a leading researcher whose work spans Governance, ESG, AI/ML, Digitalization, Cyber risk and Financial Crime, Corporate Finance, and Innovation. Her contributions have shaped policy in areas such as taxation, bonds, investment, innovation and international trade, with her expertise sought by the Australian Federal Parliament as an expert witness on critical economic and regulatory matters. With over $1.7 million in competitive research funding, including an ARC DECRA Fellowship, Dr. Akhtar's work has been recognised by prestigious institutions such as the Fulbright Commission and Oxford University. Her research has appeared in top international journals and earned multiple awards globally. She regularly presents at major conferences — including the American Finance Association — and has undertaken invited research at globally renowned universities including Harvard, MIT, and Stanford. Dr. Akhtar brings a unique interdisciplinary perspective to the future of business in the digital age.

artificial intelligent; machine learning; quantum and advance technology; tax; multinational companies; governance; ESG; Sustainability; cyber risk; risk management; public and international policy

Faculty of Accountancy, Universiti Teknologi MARA, Shah Alam, Selangor, Malaysia

Speech Title: Transforming the Accounting Profession with Artificial Intelligence: Benefits, challenges, and opportunities

Associate Professor Dr Khairul Ayuni Mohd Kharuddin is an Associate Professor in Accounting and Financial Reporting at the Faculty of Accountancy, Universiti Teknologi MARA (UiTM), Malaysia. Prior to that, she taught at Loughborough University and Aston University in the UK for about 10 years.Dr Ayuni sits in the Executive Committee of the Auditing Group of the British Accounting & Finance Association. She is a Fellow of the Association of Chartered Certified Accountants UK, and the UK Higher Education Academy. She is also the Associate Editor of the Asian Journal of Accounting Research. Her research mainly in the areas of auditing, corporate governance, and financial reporting has been published in top-ranked international journals.

Auditing; Corporate governance; Financial Accounting

Department of Accounting, Finance, and Economics, Middlesex University Business School, Middlesex University, London, UK

Speech Title: Decentralized Finance (DeFi) - The New Financial Paradigm.

Dr Ann-Ngoc Nguyen is a Senior Lecturer in Finance at Middlesex University. Her expertise spans applied econometrics, big data applications in finance, corporate finance, financial markets, and risk management. Her research focuses on market reactions to corporate disclosures, insider trading, mergers and acquisitions, and CEO pay disparity. Her work has been published in prestigious journals such as the Journal of International Financial Markets, Institutions and Money, the International Journal of Finance and Economics, and the Journal of Economic Studies. She has supervised numerous PhD students and serves as a reviewer for respected finance journals. Dr Nguyen holds degrees from Johns Hopkins SAIS and Brunel University, and has delivered both academic modules and executive training in financial risk management.

corporate finance; financial market microstructures; market-based accounting research; economics

Department of Accounting, Finance, and Business Law, College of Business, Texas A&M University-Corpus Christi; Finance Area, Academic Alliance, Texas A&M University System, RELLIS Technology and Innovation Center, USA

Speech Title: Cryptocurrencies & Blockchain Research: Past, Present, Future

Dr. Dimitrios Koutmos teaches and conducts research on the newly developing RELLIS Campus in College Station at the Texas A&M University System (and is a tenured finance faculty member with Texas A&M University - Corpus Christi). His teaching and research specializations include asset pricing and portfolio management, risk management, banking, blockchain technologies, data analytics, and financial derivatives. He has taught on a range of subjects in China, Europe, and the United States where he is privileged to have worked with a diverse student body over the years. Dimitrios' recent research on blockchain-based cryptocurrencies has featured in news outlets such as Business Insider and Yahoo! Finance and his research is regularly presented at international academic conferences. In 2025, Dimitrios was awarded the University Excellence Award by Texas A&M University - Corpus Christi for his research and scholarly activity.

asset pricing; banking; blockchain; computational finance; data analytics; fintech

Liverpool Business School, Liverpool John Moores University, Liverpool, UK

Speech Title: Central Bank Digital Currencies and the Challenges of Financial Crime in a Digital Bartering Economy.

Dr. Ahmed Eltweri is an Assistant Professor of Accounting and Finance at Liverpool John Moores University. His research interests span auditing regulation, sustainable finance, digital transformation, and financial inclusion, with publications in Scopus- and ABS-ranked journals. He supervises doctoral research, contributes to postgraduate curriculum design, and serves as an academic editor for PLOS One and guest editor for the Journal of Risk and Financial Management. Dr. Eltweri is a Fellow of the Higher Education Academy and a qualified accountant, with extensive professional training experience across the UK and the Middle East. He is bilingual in English and Arabic.

Accounting regulation; Islamic finance; Fintech

Speech Title: The Evolving Structure of Crypto Markets: Fragmentation, Risk, and Regulation.

Dr. Kirill Shakhnov is a Senior Lecturer in Economics at the University of Surrey, specializing in international finance and asset pricing. His research focuses on sovereign bonds and cryptocurrencies, with a growing interest in public finance. Prior to his current role, Dr. Shakhnov earned his Ph.D. from the European University Institute and completed a postdoctoral fellowship at the Einaudi Institute in Rome. His work is widely recognized, published in leading journals such as Management Science and the Review of Asset Pricing Studies, and has been cited extensively, particularly in the cryptocurrency literature.

international macro/finance; asset pricing; cryptocurrencies; fixed income

List of accepted submissions (70)

| Id | Title | Authors | |||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| sciforum-116626 | Innovative debt financing to bridge Saudi Arabia's climate and economic gaps |

Show Abstract |

|||||||||||||||||||||||||||||||||||||||

|

This study explores the role of innovative debt financing mechanisms in Saudi Arabia’s transition towards a sustainable and diversified economy. Specifically, it examines how green bonds and carbon credits are utilized to fund large-scale development projects, such as Neom and the Red Sea development, which focus on renewable energy and environmental sustainability. This research aims to assess the extent to which these financial instruments contribute to the achievement of both economic growth and compliance with the Kingdom’s climate commitments, as outlined in Vision 2030. This research adopts a case study approach, analyzing the impact of green finance on sustainable development initiatives in Saudi Arabia. It further incorporates artificial intelligence tools to empirically assess the relationship between innovative financing and economic growth, providing a data-driven analysis of the effectiveness of these mechanisms in fostering long-term economic and environmental benefits. This study also considers the integration of Islamic finance instruments, such as Islamic bonds, within the framework of dynamic asset pricing models and financial econometrics. This theoretical alignment helps to highlight the potential of Islamic finance to support global sustainability goals, alongside conventional financing methods. The findings of this research indicate that green finance mechanisms, including carbon credits and green bonds, are essential for financing renewable energy projects and driving economic diversification in Saudi Arabia. Additionally, the integration of Islamic finance tools strengthens the financial infrastructure and enhances the alignment of Saudi Arabia’s financing strategies with international sustainability initiatives. In conclusion, this study demonstrates that innovative debt financing can effectively address Saudi Arabia’s environmental and economic challenges. This research underscores the importance of incorporating Islamic finance tools into financial frameworks, offering practical insights for policymakers and financial institutions on how to leverage innovative financing mechanisms to support sustainable development in this region. |

|||||||||||||||||||||||||||||||||||||||||

| sciforum-121030 | Artificial Intelligence and Machine Learning in Fraud Detection: A Comprehensive Bibliometric Mapping of Research Trends and Directions |

,

Saptarshi Datta ,

|

Show Abstract |

||||||||||||||||||||||||||||||||||||||

|

This study presents a bibliometric analysis of emerging trends in applying Artificial Intelligence (AI) and Machine Learning (ML) for financial fraud discovery and deterrence and provides insights for future research. Bibliometric analysis on fraud data analytics is helpful to researchers in getting insights on research trends, research impact and classification. However, research on fraud data analytics using machine learning is limited. The main objective of this quantitative analysis is to explore emerging trends in fraud data analytics and machine learning (ML) for financial crime detection and prevention. Bibliometric data has been collected from the Scopus database. One thousand four hundred eighty-three documents from the SCOPUS database have been analysed using VOSviewer. The data analysis divulges a growing interest in leveraging these technologies to strengthen financial crime detection. Fraud data analytics, Artificial Intelligence and Machine Learning are vital in identifying complex criminal patterns, strengthening companies in preventive vigilance, and ensuring fraud elimination. The study portrays the need for vigorous frameworks for the legislature, real-time analytics systems and more powerful tools and calls for integrating governments, financial institutions, and technology providers to strengthen prevention strategies and tackle financial crimes more effectively. It is recommended that companies should invest on AI & ML for the detection of fraud at the early stages. |

|||||||||||||||||||||||||||||||||||||||||

| sciforum-117316 | Does ESG Affect Bank Risk? | , |

Show Abstract |

||||||||||||||||||||||||||||||||||||||

|

Beyond the disruptions from the 2007–2008 financial crisis, the collapse of the Silicon Valley Bank, and acquisition of Credit Suisse by UBS Group AG in 2023, global banks continue to show weakness in absorbing major on- and off-balance sheet risk exposures. This study focuses on the joint and separate effects of Environmental (E), Social (S), and Governance (G) scores on bank risk captured both by a series of market related risk indices including cost of capital, and both levered and unlevered CAPM betas. Using a sample of U.S. banks over the period 2016 through 2023, banks’ financial and market data are triangulated with the total and composite ESG scores, all obtained from the London Stock Exchange Group (LSEG) database, formerly known as Refinitiv. The main hypotheses predict that (i) investors demand a lower cost of capital from banks with higher ESG scores, and (ii) banks with higher ESG scores are exposed to lower systematic risks captured both by levered and unlevered betas. Overall, we contend that banks with higher ESG scores establish better operational alignment with employees, shareholders, customers, consumers, and communities while exercising greater due diligence by focusing on a pool of environmentally conscientious borrowers . The paper’s contributions to the literature is twofold. First, unlike previous studies, the focus on cost of capital and systematic risk indices captures the crucial interactions between ESG investment and firm decisions resulting from market imperfections and regulations. Second, empirical adjustments are made to address potential endogeneity problems in the model caused by factors such as reverse causality between ESG investment and risk, omitted variables, and measurement errors using the instrumental variables technique and application of simultaneous equation systems including the Seemingly Unrelated Regression (SUR) and Two Stage Least Square (2SLS) approaches. |

|||||||||||||||||||||||||||||||||||||||||

| sciforum-120788 | AI's Role in Shaping the Future of Economic and Financial Analysis in the Pursuit of the Macroeconomic Scenario | , , |

Show Abstract |

||||||||||||||||||||||||||||||||||||||

|

This study examines the inherent complexity of artificial intelligence (AI), its influence on economics and finance, and how it has triggered tremendous shifts in the global economic landscape. Thus, it reveals new patterns that have never been seen due to deep learning, artificial intelligence, machine learning, and natural language processing, which are revolutionizing data analysis. In keeping with all of them, it offers numerous advantages, such as the ability to detect delinquent behavior, reduce the risk of adverse effects, perform algorithmic trading, and improve the prediction of the macroeconomic scenario. As an optical illusion of substance in economics, artificial intelligence is a multi-faceted door to subversive studies and analysis using unusual methodologies that question and revise established statistical and economic principles. This is increasingly true when applying artificial intelligence to many problems, from behavioral finance to new forecasting systems, to improve our understanding of global markets. This allows college students to tailor their experiences, conduct real-time data analysis, and apply artificial intelligence to bring theory to the street. This might be useful for scholars too; therefore, all types of future work should cover data privacy concerns, algorithmic bias, and ethical issues. The practical application of artificial intelligence technology in the financial and economic fields is not an isolated technological pursuit but requires interdisciplinary collaboration. |

|||||||||||||||||||||||||||||||||||||||||

| sciforum-120694 | Investing in the Age of Generative AI: A GPT-based Sentiment Analysis Approach |

Show Abstract |

|||||||||||||||||||||||||||||||||||||||

|

Generative AI, which ushers a new age of AI, comes with huge economic potential. AI startups, like OpenAI, Anthropic, and DeepSeek, and technology giants, like Google, Amazon, Microsoft, and Meta, compete in the Generative AI market. To not fall behind in the AI race, they have ramped up AI investment with massive capital spending. For example, on January 3, 2025, Microsoft announced that the company is on track to invest approximately USD 80 billion to build AI-enabled data centers to train AI models and deploy AI- and cloud-based applications around the world in fiscal 2025. Also, on January 21, 2025, an AI joint venture called the Stargate Project was created by OpenAI, SoftBank, Oracle, and MGX. The venture plans to invest USD 500 billion in AI infrastructure by 2029. On January 24, 2025, Meta announced that the company plans to build a massive data center in Louisiana to power its newest AI model. It would invest USD 60-65 billion into AI including the data center, which would be “so large it would cover a significant part of Manhattan”. To capitalize on the AI boom, investors are interested in trading AI stocks. AI chatbots, which can identify and classify sentiments from financial news, can be leveraged for investment. So, this paper proposes a GPT-based sentiment analysis approach for trading AI stocks. Also, natural experiments are conducted to evaluate its effectiveness. The initial results show that the approach achieves a good rate of return. |

|||||||||||||||||||||||||||||||||||||||||

Registration

The registration for IOCRF 2025 will be free of charge! The registration includes attendance to all conference sessions.

If you are registering several people under the same registration, please do not use the same email address for each person, but their individual university email addresses. Thank you for your understanding.

Please note that the submission and registration are two separate parts. Only scholars who registered can receive a link to access the conference live streaming. The deadline for registration is 13 June 2025.

Instructions for Authors

The 1st International Online Conference on Risk and Financial Management: Big Data, Artificial Intelligence, and Machine Learning in Finance will accept abstracts only. The accepted abstracts will be available online on Sciforum.net during and after the conference.

1. Deadline for abstract submission: 17 March 2025.

2. Deadline for abstract acceptance notification: 17 April 2025.

You will be notified of the acceptance of an oral/poster presentation in a separate email.

Abstract submissions should be completed online by registering with www.sciforum.net and using the "Submit Abstract" function once logged into the system. No physical template is necessary.

1. The structure abstract should include the introduction, methods, results, and conclusions sections of about 200–300 words in length.

2. All abstracts should be submitted and presented in clear, publication-ready English with accurate grammar and spelling.

3. You may submit multiple abstracts. However, only one abstract will be selected for oral presentation.

4. The abstracts submitted to this conference must be original and novel, without prior publication in any journals or it will not be accepted to this conference.

Detailed Requirements:

1. The submitting author must ensure that all co-authors are aware of the contents of the abstract.

2. Please ensure that all co-author information is thoroughly completed when submitting your abstract to prevent any omissions.

3. The requirements for full affiliation include:

(1) Department/School/Faculty/Campus;

(2) University/Company/Institute;

(3) City;

(4) Post/ZIP code or equivalent, where available;

(5) Country.

4. Please select only one presenter for each submission. If you would like to change the presenter after submission, please email us accordingly.

Note: We only accept live presentations.

Authors are encouraged to prepare a presentation in PowerPoint or similar software, to be displayed online along with the abstract. Slides, if available, will be displayed directly on the website using the proprietary slide viewer at Sciforum.net. Slides can be prepared in exactly the same way as for any traditional conference where research results are presented. Slides should be converted to PDF format prior to submission so that they can be converted for online display.

- Size in pixel: 1080 width x 1536 height–portrait orientation.

- Size in cm: 38,1 width x 54,2 height–portrait orientation.

- Font size: ≥16.

- Examples of successful submissions can be viewed here at the following links: (1), (2), (3).

- You can use our free template to create your poster.

All accepted submissions will be permanently displayed online in the Poster Gallery. Once your submission is accepted, you can upload your poster in the "My submission" section. Simply select the correct conference and submission, then click the upload button.

All accepted authors and registered participants will receive a Certificate of Participation as recognition of their contribution to IOCRF2025.

Certificates of Participation are available in your logged-in area of Sciforum.net, under “My Certificates” after the conference.

It is the authors' responsibility to identify and declare any personal circumstances or interests that may be perceived as inappropriately influencing the representation or interpretation of clinical research. If there is no conflict, please state "The authors declare no conflicts of interest." This should be conveyed in a separate "Conflict of Interest" statement preceding the "Acknowledgments" and "References" sections at the end of the manuscript. Any financial support for the study must be fully disclosed in the "Acknowledgments" section.

MDPI, the publisher of the Sciforum.net platform, is an open access publisher. We believe authors should retain the copyright to their scholarly works. Hence, by submitting an abstract to this conference, you retain the copyright to the work, but you grant MDPI the non-exclusive right to publish this abstract online on the Sciforum.net platform. This means you can easily submit your full paper (with the abstract) to any scientific journal at a later stage and transfer the copyright to its publisher if required.

Publication Opportunity

2. Proceeding Paper Publication

All accepted abstracts will be published in the conference report of IOCRF 2025 in Proceedings (ISSN: 2504-3900); if you wish to publish an extended proceeding paper (4-8 pages), please submit it to the same journal after the conference.

Authors are asked to disclose that it is a proceeding paper of the IOCRF 2025 conference paper in their cover letter. Carefully read the rules outlined in the 'Instructions for Authors' on the journal’s website and ensure that your submission adheres to these guidelines.

Proceedings submission deadline: 31 July 2025

Authors are encouraged to use the Microsoft Word template or LaTeX template to prepare their manuscript.

Manuscripts for the proceedings issue must be formatted as follows:

Title.

Full author names.

Affiliations (including full postal address) and authors' e-mail addresses.

Abstract.

Keywords.

Introduction.

Methods.

Results and Discussion.

Conclusions.

Acknowledgements.

References.

Event Awards

To acknowledge the support of the conference's esteemed authors and recognize their outstanding scientific accomplishments, we are pleased to announce that the conference will provide multiple awards including JRFM Distinguished Research Award, Best Oral Presentation Awards and Best Poster Awards.

The Awards

Number of Awards Available: 1

The recipient of the JRFM Distinguished Research Award will receive:

1. A 25-minute presentation slot at IOCRF2025 (including a 5-minute introduction by the nominator and a 20-minute presentation by the awardee).

2. A certificate and a prize of 500 CHF.

3. A full waiver for publication in Journal of Risk and Financial Management (JRFM).

Nominations are invited from the pool of submitted abstracts. To be considered for the award, nominations must be submitted via email to iocrf@mdpi.com and include the following:

1. Names and affiliations of both the nominator and the nominee.

2. Title of the nominated abstract and Sciforum ID.

3. A letter of recommendation from the nominator, clearly stating their relationship to the nominee and the significance of the nominated research.

1. Nominations must be based on abstracts already submitted to the conference. Self-nominations are not permitted.

2. By submitting a nomination, both the nominator and the nominee agree that all information provided is accurate and that they comply with the conference’s rules and guidelines.

3. The winner of this award will not be eligible for the Best Oral Presentation Award or Best Poster Award.

4. Any conflicts of interest must be disclosed at the time of nomination. The Award Committee reserves the right to disqualify any nomination that does not adhere to these guidelines.

Number of Awards Available: 6

The Best Oral Presentation Awards are given to the submission judged to make the most significant oral contribution to the conference.

The Best Poster Awards are given to the submission judged to make the most significant and interesting poster for the conference.

There will be six winners selected for these awards. The winner will receive a certificate and 200 CHF each.

Sponsors and Partners

For information regarding sponsorship and exhibition opportunities, please click here.

Organizers

Media Partners

Conference Secretariat

S1. Machine Learning in Economics and Finance

In big data analytics, sentiment analysis has become a vital tool by offering a route to convert raw big data in digital text format into interpretable form via a series of processes. Textual data may be extracted from a variety of resources, such as news coverage, social media, company reports and documents from institutions. Sentiment analysis examines the text and provides insights regarding the topics determined by the researcher such as measuring the emotions, creating topic clusters and identifying latent topics. There are several approaches to measure sentiments, from lexicon-based approaches to deep learning and machine learning algorithms. In the field of finance, sentiment analysis has started to become considerably popular to measure investor sentiments or market tendencies, and several lexicons are created for this purpose. However, there is a gap in the sources of the texts that are used in empirical research as many of the most influential international organizations are mostly ignored. In that regard, organizations, such as IMF and UN, provide different source information on global issues compared to the standard news coverage as their announcements are mostly directed to the international community. We hope that sentiment analysis based on the texts of these organizations may be of help in the gauging and understanding of the direction of commodity prices and energy prices in general. In this regard, the conference session will consider all recent contributions in sentiment analysis spanning all possible areas of applications.

Session Chair

Prof. Dr. Thanasis Stengos, Department of Economics and Finance, University of Guelph, Canada

Show all published submissions (23) Hide published submissions (23)

Submissions

List of Papers (23) Toggle list

S2. AI in Economics and Finance

Session Chair

Prof. Dr. Svetlozar Zari Rachev, Department of Mathematics and Statistics, Texas Tech University, Lubbock, USA

Show all published submissions (15) Hide published submissions (15)

Submissions

List of Papers (15) Toggle list

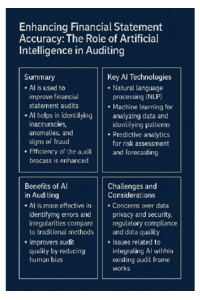

S3. AI in Financial Reporting and Auditing

The rapid advancement of artificial intelligence (AI) is revolutionizing financial reporting and auditing, offering unprecedented opportunities to enhance efficiency, accuracy, and transparency in these critical areas of business. This session explores how AI-driven technologies are reshaping traditional practices and addressing emerging challenges in financial reporting and auditing.

Key Discussion Topics:

-

AI-Powered Financial Reporting: How AI tools can automate data preparation, streamline financial statement generation, and ensure compliance with ever-evolving regulatory standards.

-

Auditing with AI: Leveraging AI to enhance fraud detection, assess risks, and analyze large volumes of transactional data for anomalies, patterns, and irregularities, enabling deeper insights and more robust assurance processes.

-

Textual Analysis in Disclosures: The use of AI for analyzing corporate narratives, identifying trends, and gauging the tone and sentiment of financial disclosures, offering stakeholders richer insights into a company's financial health and governance.

-

Regulatory Compliance and Standardization: Exploring the role of AI in automating compliance tasks, ensuring adherence to global financial reporting standards and reducing the risk of human errors.

-

Ethical and Practical Challenges: Addressing concerns such as algorithmic bias, data privacy, and the need for human oversight to ensure that AI adoption in financial reporting and auditing is ethical and reliable.

While the potential of AI in these domains is vast, challenges such as the "black box" problem, cost of implementation, and skill gaps remain significant. This session will critically evaluate these issues while highlighting cutting-edge research and real-world applications that demonstrate the transformative power of AI.

We invite researchers, practitioners, and policymakers to share insights, case studies, and methodologies that showcase how AI is redefining financial reporting and auditing practices. Join us as we discuss the current state of AI adoption, envision its future trajectory, and explore strategies to maximize its potential while mitigating associated risks.

Session Chair

Dr. Mahmoud Elmarzouky, St Andrews Business School, University of St Andrews, The Gateway, North Haugh, St Andrews, UK

S4. Financial Innovations and Technology

The Financial Innovations and Technology session highlights research that leverages new and emerging information technologies for financial innovations, including artificial intelligence, machine learning, big data, cloud computing, etc. This section includes topics such as AI/ML in economics and finance, AI in financial reporting and auditing, digital currencies, cryptocurrency, stablecoins, algorithmic trading, robo-advisors and computational finance. We welcome research from a variety of disciplines like statistics, finance, information systems, computer science, etc. This section considers papers from all research methods.

Session Chair

Prof. Dr. Xianrong (Shawn) Zheng, Information Technology & Decision Sciences Department, Old Dominion University, USA

Show all published submissions (12) Hide published submissions (12)

Submissions

List of Papers (12) Toggle list

S5. Future of Money: Central Bank Digital Currencies, Cryptocurrencies and Stablecoins

What is money? For centuries, we have relied on it to trade, save, and build our economies. But is this age-old concept about to undergo a radical transformation? In this session, we delve into the cutting-edge developments that could redefine what money means in the digital age.

Connect with a vibrant network of innovators and thought leaders who are at the forefront of financial technology. This is your chance to be part of a groundbreaking conversation that explores the future of money.

Topics of Interest:

- Central Bank Digital Currencies (CBDCs): Could these digital versions of national currencies revolutionize how we think about money and monetary policy?

- Cryptocurrencies: How are these decentralized digital assets challenging traditional financial systems and what does this mean for the future?

- Stablecoins: Can these digital currencies provide the stability needed in the volatile world of cryptocurrencies?

Presenting at this session offers a unique opportunity to showcase your research and innovations to a diverse audience of industry leaders, academics, and policymakers. Share your insights, gain valuable feedback, and collaborate with peers who are passionate about the future of digital finance. This is your forum to influence the dialogue on the future of money.

Session Chair

Prof. Dr. Ramona Rupeika Apoga, Faculty of Business, Management and Economics, University of Latvia, Latvia

Show all published submissions (10) Hide published submissions (10)

Submissions

List of Papers (10) Toggle list

_Zheng.png)